For middle-class individuals, investment is not just advisable—it is essential. With limited income and unpredictable expenses, often influenced by unavoidable social obligations, managing finances can be a challenge. In such a landscape, the returns on savings serve as the cornerstone for future financial planning.

Thoughtful and trustworthy investments are key to growing wealth, outpacing inflation, and achieving long-term goals such as homeownership, higher education, and a secure retirement. Typically, middle-class investors seek:

- Consistent returns

- Capital preservation

- Gradual wealth accumulation

- Financial independence

They aim to strike a prudent balance between risk and reward in pursuit of a stable and secure future.

The average individual, particularly those without a background in finance, often lacks the time, tools, and resources to stay aligned with the constantly evolving financial markets.

Moreover, understanding the intricate web of internal and external economic variables—and their impact on investment decisions—requires a level of expertise many may not possess.

A Turning Point in My Financial Journey

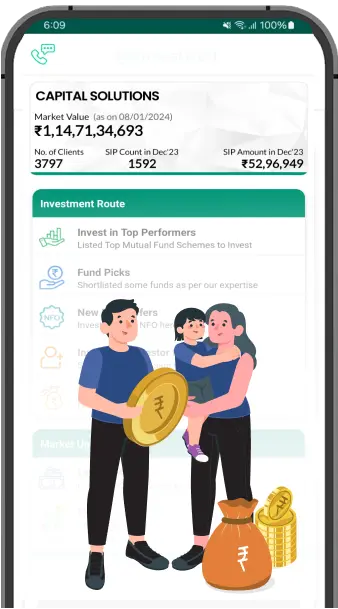

My approach to investing transformed after I began working with Excellent F&T Services. This firm assumed complete responsibility for managing my investments and addressed every concern I raised during our discussions at BASIS.

Not only were my stated goals met—they were exceeded. Even my unspoken expectations were anticipated and fulfilled, far beyond what I had imagined.

Excellent F&T Services has brought clarity and confidence by paving certainty in “uncertain market” through its punctuality, unwavering dedication, and committed service. Their devotional approach, strong team spirit, creative and welcoming culture, thorough research, regularly updated information database, and ongoing pursuit of knowledge have all contributed to a dynamic blend of professionalism and meaningful relationships.

When my friends see me consistently joyful, confident, stable, and content, their curiosity will get the better of them—they’ll press me to reveal the secret behind my financial well-being. And I’ll have no choice but to share it: if they too wish to enjoy the same peace of mind, they must turn to Excellent F&T Services.

For middle-class individuals, investment is not just advisable—it is essential. With limited income and unpredictable expenses, often influenced by unavoidable social obligations, managing finances can be a challenge. In such a landscape, the returns on savings serve as the cornerstone for future financial planning.

Thoughtful and trustworthy investments are key to growing wealth, outpacing inflation, and achieving long-term goals such as homeownership, higher education, and a secure retirement. Typically, middle-class investors seek:

- Consistent returns

- Capital preservation

- Gradual wealth accumulation

- Financial independence

They aim to strike a prudent balance between risk and reward in pursuit of a stable and secure future.

The average individual,

More...